Jenna of speaks clearly about her family's struggle with figuring out the best way to deal with health insurance. After leaving a bit of a ranting comment on her post (something I rarely do) I realized perhaps I should be sharing in my own space as well.

•••

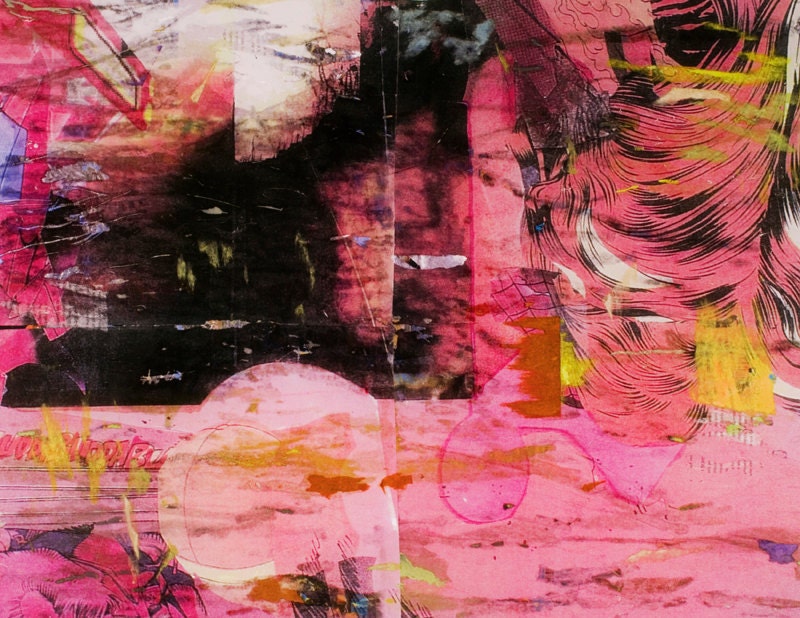

Note: this post is super long. So before you panic and leave altogether, please head over to Kate Miss', For Me-For You shop to purchase a piece of artwork. All profits go towards her partner's health bills-- he is a painter (one of his pieces above) with no insurance, and was just diagnosed with testicular cancer. (I assume she will be adding and re-listing regularly, so be sure to check back if nothing at the moment catches your fancy.)

•••

Let me start by saying G and I have been relatively healthy people all our lives. No big hospital emergencies, no "conditions" or "illnesses." While living in Brooklyn, when I became responsible for my own insurance, I got the bottom tier (read: cheapest) Freelancers Union health insurance plan for years. I would sometimes joke, usually when the monthly bill was especially hard to swallow, that I better get sick to take advantage of "all this insurance" I was paying for. (Note to everyone: do not joke about these things.) G, a freelancer as well, didn't have health insurance at all after leaving his parents' plan.

Right before we moved to Providence, G accepted a job in NY that allowed him to telecommute. He also got a really sweet health insurance plan. Cool. At some point it occurred to him to take advantage of it. He got the various routine check ups. Then he got cancer.

His job is many things, (and we can find ways to complain about all of them,) but we often remind ourselves that it paid for his Melanoma treatment. And continues to do so. I cannot overstate how screwed we would be if he hadn't taken that job. If the universe hadn't aligned to let it work out. We would have gotten by with help from family and friends, but it would have been hard, and the whole thing just that much scarier.

Three years later, a few months before our wedding, last March, I was diagnosed with Crohns. --A chronic disease that I will have for the rest of my life. (It's quite manageable at the moment though.) A few diagnostic tests I couldn't have put off, but in hindsight there were several procedures that I could have waited on until I transferred to G's insurance plan after we got married. But honestly, it didn't occur to me. I wasn't even positive I would switch to his plan at all. I had health insurance: I was sick: I didn't think twice about using it. It wasn't until the bills started coming in that the whole health insurance debacle our country is facing truly hit home.

For the first time, I really understood how a stable family could be crippled in months and end up declaring bankruptcy over medical bills. We're both relatively responsible people, but we simply didn't have extra thousands of dollars to put towards unexpected bills, never mind on top of a wedding. My insurance did pay a portion, yes. However, when something costs upwards of $4000 and half is covered... you get the idea. I called and developed payment plans for all of the bills except, ironically the largest one. I received both a CT Scan and an MRI and this particular facility didn't "do payment plans." You had sixty days after your initial payment, of whatever you could afford, to pay the balance. After that, your account would go towards a collections agency. It boggles my mind that this is their policy. (As I type, I realize I should be sending them a letter as well.) I do not understand how this could be more cost effective than letting me pay it down little by little. Anyways, we managed to pay that bill first and now still put a bit down every month to the others.

I have since switched to G's insurance plan. I'm both giddy at, and appalled by, how easy and inexpensive my medical treatment now is. How can the discrepencies in plans be this vast? Frankly, I feel like a bit of jerk every time I waltz in to an appointment. My monthly prescriptions now cost a mere $35 (and soon will be less when I'm fully enrolled in the mail order plan,) from a heart stopping $400. (Don't get me started on how these medications keep more expensive procedures--hospital stays, cancer, etc-- at bay. Don't worry, I won't get into the baffling lack of value placed on preventative care here.)

I realize I must sound naive and spoiled to people who have long suffered without insurance at all. And I fully own up to it. We are blessed to be two college educated, creative, financially-stable adults. If we are struggling, how in the world are other people getting by? (The obvious answer is that they are not.) I know we are so lucky. And I am truly, deeply grateful. And also furious.

For the first time in our lives, our health has become a factor in our career choices. That kills me. And if we are wrestling with these decisions, surely a large number of our peers are as well. The population who are supposed to be forging ahead, making changes, creating jobs, bringing about innovation for future generations. To find our career paths so narrowed by one force is not only personally disheartening, but surely is grim for our society as a whole.

I'll stop here, and only remind you to visit the For Me-For You shop. You can learn more about the fundraiser on her beautiful blog here. (We just purchased a print of the painting above and I'm so excited for it to arrive!) You may also know Kate Miss from her wildly popular necklaces she hand makes. They are for sale in batches and often sell out in hours. So sign up for her newsletter while you're over there.

Hey check it out!-- Our wedding was featured in the Providence Journal (also known as the Projo around these parts,) in a section about DIY Weddings. We got interviewed and everything. Was not expecting a full page in color though. Sweet!

Hey check it out!-- Our wedding was featured in the Providence Journal (also known as the Projo around these parts,) in a section about DIY Weddings. We got interviewed and everything. Was not expecting a full page in color though. Sweet!

So I thought I'd do an update on our

So I thought I'd do an update on our